Once Insured is Always Insured

Table of Contents

Toggle

Why Whole Life Plans?

Here are some of the key USPs of Whole Life Insurance Plans:

- Lifetime Coverage: Whole life insurance provides coverage for your entire life, unlike term life insurance which has a specific term. This ensures financial security for your loved ones even after you’re gone.

- Cash Value Accumulation: A portion of your premium goes towards building a cash value within the policy. This cash value grows over time and can be accessed through loans or withdrawals, subject to terms and conditions.

- Tax Advantages: The cash value in a whole life policy grows tax-deferred, meaning you won’t owe taxes on the growth until you withdraw it. Additionally, death benefits are generally tax-free to beneficiaries.

- Fixed Premiums: Unlike some other life insurance policies, whole life insurance typically has fixed premiums, meaning your monthly or annual payment won’t change over the life of the policy.

- Additional Benefits: Some whole life policies offer additional features like riders that can provide extra coverage for specific needs, such as critical illness or long-term care.

LIC Whole Life Plans offer numerous benefits, including:

Key Benefits:

- Lifetime Coverage: Protection until age 100.

- Savings Component: Accumulation of cash value.

- Guaranteed Death Benefit: Nominee receives sum assured.

- Maturity Benefit: Policyholder receives sum assured at maturity (age 100).

- Bonus Eligibility: Participates in LIC’s profits.

- Loan Facility: Up to 80% of surrender value.

- Tax Benefits: Section 80C and 10(10D) benefits.

Additional Benefits:

- Accidental Death Benefit Rider (optional)

- Critical Illness Rider (optional)

- Disability Benefit Rider (optional)

- Waiver of Premium Rider (optional)

- Income Benefit Rider (optional)

Advantages:

- Long-term financial security

- Forced savings discipline

- Protection for family

- Potential for bonus earnings

- Flexibility in premium payment

- Option to add riders for enhanced protection

- Government-backed security

Popular LIC Whole Life Plans:

- LIC Jeevan Umang (Table No. 745)

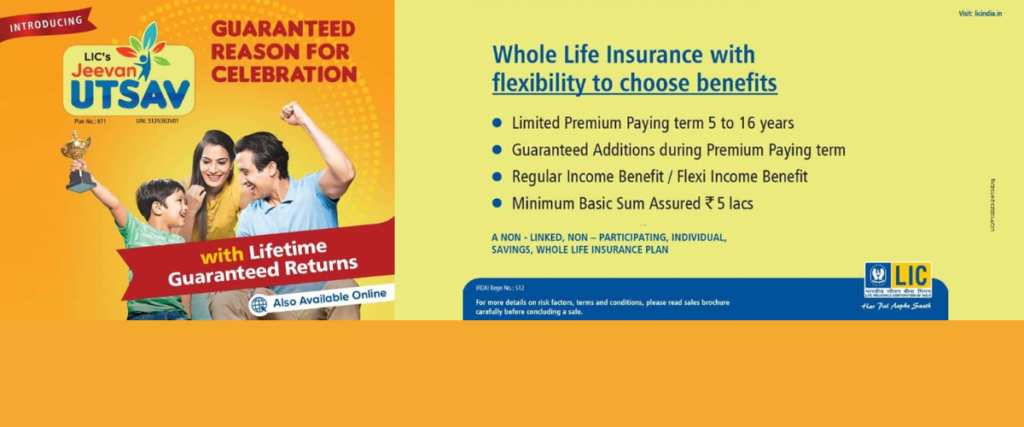

- LIC Jeevan Utsav (Table No. 771)

Eligibility:

- Age: 30 Days-65 years (Varies by Plan)

- Policy Term: Lifetime (up to the age of100)

- Sum Assured: ₹2Lakh/5 Lakh – No upper Limit (Varies by Plan)

Why Choose LIC Whole Life Plans?

- Lifetime protection

- Savings component

- Guaranteed death benefit

- Bonus eligibility

- Government-backed security

- Flexibility in premium payment

- Option to add riders

LIC Whole Life Plans provide comprehensive protection and savings, making them a popular choice for long-term financial planning.

Would you like more information on specific plans, premium rates, or comparisons with other insurance products?

LIC Jeevan Umang T-745

LIC Jeevan Umang (Table No.745) is a whole life insurance plan with the following Unique Selling Points (USPs):

Key Features:

1. Lifetime Coverage: Protection up to age 100.

2. Guaranteed Death Benefit: Nominee receives sum assured.

3. Maturity Benefit: Policyholder receives sum assured at age 100.

4. Bonus Eligibility: Participates in LIC’s profits.

5. Loan Facility: Up to 80% of surrender value.

USPs:

1. Whole Life Coverage with Limited Premium Payment Term (15-30 years).

2. Guaranteed Benefits, Increasing Risk Cover and Maturity Benefit.

3. 8% Annual Interest on Sum Assured Lifetime.

4. Participation in LIC’s Profits through Bonus.

5. Flexible Premium Payment Options (Annual, Semi-Annual, Quarterly, Monthly).

6. Option to Add Riders for Enhanced Protection.

7. Tax Benefits under Section 80C and 10(10D).

8. Government-Backed Security( Sovereign Guarantee ).

Benefits:

1. Death Benefit: Nominee receives sum assured + bonus.

2. Maturity Benefit: Policyholder receives sum assured + bonus.

3. Survival Benefit: 8% of sum assured every year after PPT ends.

4. Loan Facility

5. Bonus: Participates in LIC’s profits.

Eligibility:

1. Age: 30 days -55 years.

2. Policy Term: Lifetime (up to age 100).

3. Premium Payment Term: 15-30 years.

4. Sum Assured: ₹2 lakhs – No Limit.

Why Choose LIC Jeevan Umang?

1. Lifetime protection

2. Guaranteed death benefit and maturity benefit

3. Bonus eligibility

4. Flexible premium payment options

5. Government-backed security

6. Tax benefits

7.Taxfree Survival benefit Lifetime

8. Best For The Newly Borne Children.

LIC Jeevan Umang provides comprehensive protection and savings, making it a popular choice for long-term financial planning.

Would you like more information on LIC Jeevan Umang or comparisons with other insurance products?

LIC Jeevan Utsav T-771 is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan offered by the Life Insurance Corporation of India (LIC). It provides financial protection for your family in case of unfortunate demise and also offers survival benefits.

Key Features:

- Limited Premium Payment Term: You can choose a premium payment term of 5 to 16 years, making it convenient to manage your finances.

- Guaranteed Benefits: The plan offers guaranteed benefits, including death benefits and survival benefits, providing financial security.

- Flexible Income Options: You can choose between Regular Income Benefit or Flexi Income Benefit, allowing you to tailor the plan to your specific needs.

- Tax Benefits: Premiums paid and benefits received may be eligible for tax benefits under applicable tax laws.

Benefits:

- Death Benefit: In case of the policyholder’s unfortunate demise, a lump sum death benefit is paid to the nominee along with accrued guaranteed additions.

- Survival Benefits: Depending on the chosen option, you can receive regular income or flexible income benefits for your lifetime.

Eligibility & Features –

Age : 90 Days – 65 Years

Premium Paying Term (PPT) : 5 Year – 16 Year

Sum Assured : 5 Lakh – No Upper Limit.

Riders – ADDB(Accidental Death & Disability Benefit Rider)- Up To The Age of 70 Years.

Survival Benefit : 10% of The Sum Assured Will Be Paid To The Policyholder Every Year(Whole Life).

Death Benefit : Basic Sum Assured + Bonus Accrued Till Date.