Steps of Financial Freedom

Table of Contents

Toggle

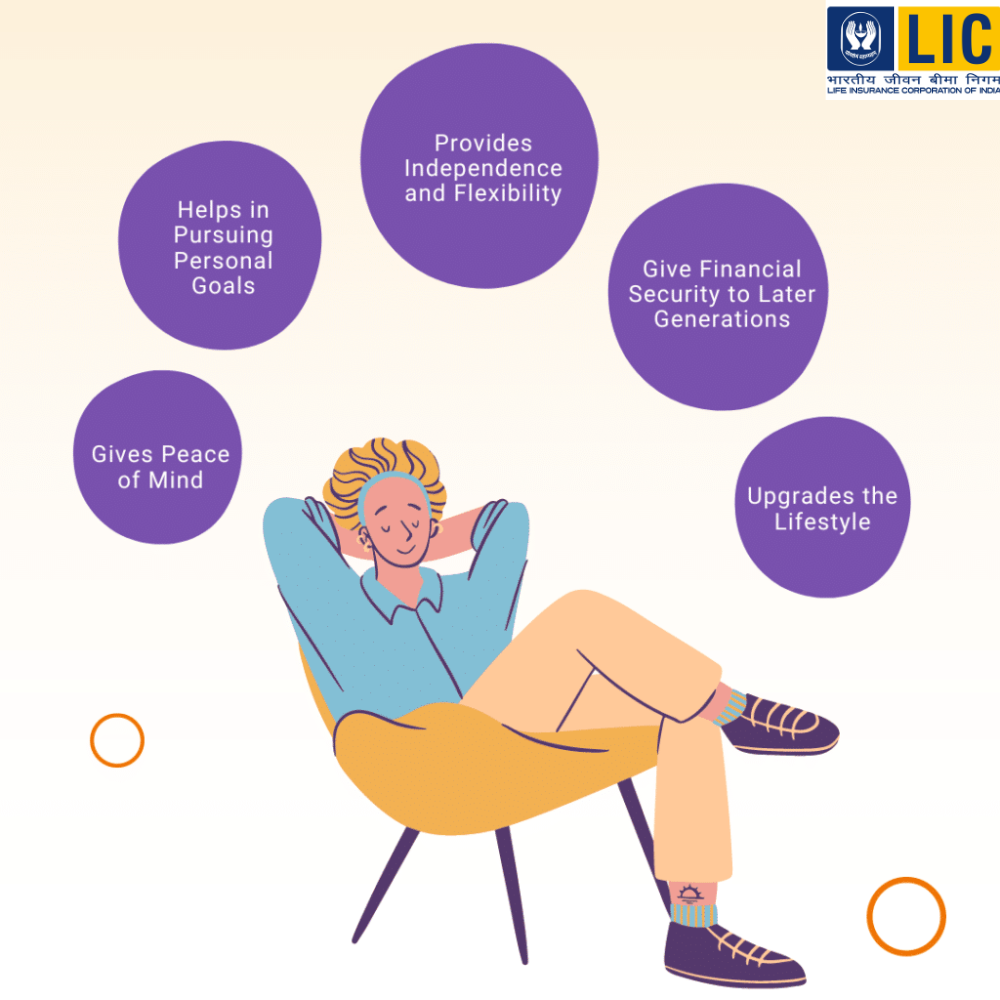

‘Financial Freedom’ is a state where an individual has sufficient resources to pursue their Goals, Values, and Passions without being constrained by Financial Stress or Limitations. It’s a Mindset and a Lifestyle that allows people to live life on their own terms.

Some key elements of Financial Freedom include:

1. Financial Independence: Not relying on others for financial support.

2. Debt Freedom: Being debt-free or having manageable debt.

3. Savings and Wealth: Having enough savings and investments to cover expenses.

4. Passive Income: Earning income without actively working.

5. Financial Security: Having a safety net for unexpected expenses.

6. Flexibility: Having choices and freedom to pursue opportunities.

7. Peace of mind: Feeling secure and confident about one’s financial situation.

Here’s How Your LIC Agency can help you achieve ‘Financial Freedom’ :

Income Streams

1. Commission-based Income : Earn commissions on policy sales, renewals, and premiums.

2. Renewal Commissions: Receive commissions on existing policy renewals.

3. Bonus and Incentives: Eligible for bonuses, rewards, and recognition programs.

4. Team Building: Recruit and mentor sub-agents, earning override commissions.

Financial Benefits

1. Attractive commission rates (up to 28% on first-year premiums)

2. Guaranteed income through ‘Renewal Commissions’

3. Pension and Gratuity schemes for long-term service

4. Medical benefits for self and family

Business Growth

1. Diversified product portfolio: Offer various insurance plans (life, health, pension)

2. Expanding client Base: Build relationships, acquire new clients

3. Cross-selling and Up-Selling: Increase average policy value

4. Referral Incentives: Encourage client referrals

Training and Development

1. Professional Training: Develop sales, marketing, and financial planning skills

2. Industry Updates: Stay informed about market trends and regulatory changes

3. Leadership Development: Opportunities for leadership roles within LIC

4. Mentorship Programs: Guidance from experienced agents and leaders

Support System

1. Dedicated Agency manager and team support

2. Access to LIC’s Technology and Infrastructure (You have the liberty to Submit Your New Business Proposals To any Office Premises of LIC of INDIA, Across The Country, ANANDA Portal Provides you to remotely login your proposals online anytime from anywhere etc.)

3. Marketing and Promotional support

4. Networking opportunities with other agents and industry professionals

Flexibility and Autonomy

1. Be your own boss: Work independently, set own goals and schedule

2. Flexibility in work hours and location

3. Opportunity to build a legacy: Establish a sustainable agency

Long-term Wealth Creation

1. Savings and investment opportunities through LIC policies

2. Pension plans for retirement security

3. Wealth creation through Equity participation (ELSS, ULIPs)

4. Tax benefits on policy premiums and proceeds

Action Plan

1. Set clear financial goals and targets

2. Develop a business development plan

3. Focus on customer relationships and service

4. Continuously improve knowledge and skills

5. Monitor progress and adjust strategies

By leveraging these benefits and opportunities, your LIC agency can help you achieve financial freedom through:

– Consistent income growth

– Business expansion and diversification

– Strategic savings and investments

– Leadership development

– Long-term planning and discipline

Remember to stay committed, adaptable, and focused on your goals. Here we will provide you all the tools, Infrastructure & support system you will need to grow your career. The only thing is that you have to take your first step, rest of the things will be taken care of.

True Financial Freedom is comprised of : Good Health, Abundant Wealth & Happiness. For wealth we provide you a robust working system & For Health You will need to do work out and social association for which you need free time and Your LIC Agency career will provide you leisure time that will help you to have a sound health. Once these two are achieved ‘Happiness’ will follow you eventually.

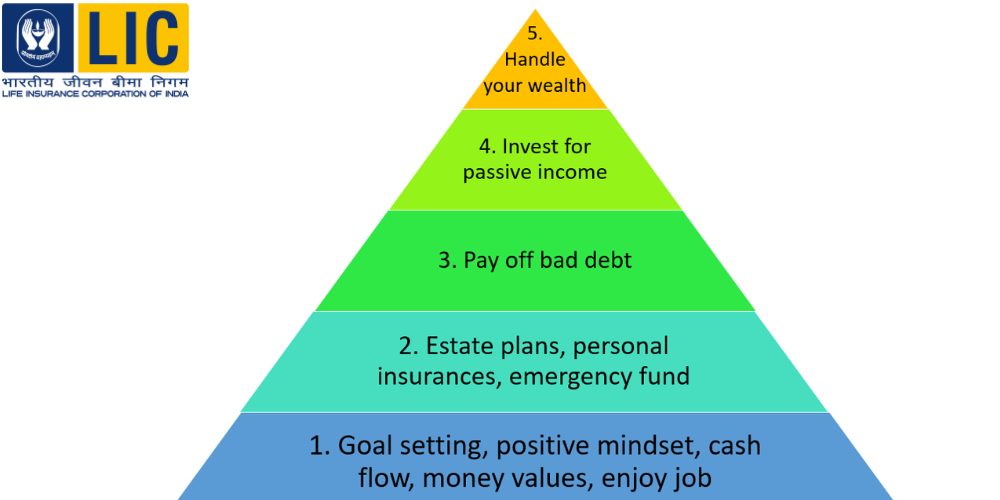

The key steps to achieving financial freedom:

1. Define Your Financial Goals:

- Set Clear Objectives: Determine what financial freedom means to you. Is it early retirement, a comfortable lifestyle, or something else?

- Break Down Goals: Divide your long-term goals into smaller, achievable milestones.

2. Create a Budget:

- Track Income and Expenses: Understand your income sources and where your money goes.

- Allocate Funds: Prioritize essential expenses like housing, food, and utilities.

- Set Aside Savings: Dedicate a portion of your income to savings and investments.

3. Pay Off Debt:

- Prioritize High-Interest Debt: Focus on paying off credit cards and other high-interest loans.

- Debt Avalanche or Debt Snowball: Choose a strategy to systematically eliminate debt.

4. Build an Emergency Fund:

- Aim for 3-6 Months’ Expenses: This fund will cushion you against unexpected financial setbacks.

5. Invest Wisely:

- Start Early: The power of compound interest can significantly grow your investments over time.

- Diversify: Spread your investments across various asset classes to reduce risk.

- Seek Professional Advice: Consider consulting a financial advisor to tailor an investment strategy to your goals.

6. Increase Your Income:

- Side Hustle: Explore additional income sources like freelancing or part-time jobs.

- Skill Enhancement: Invest in your skills to command higher salaries or better job opportunities.

7. Live Below Your Means:

- Mindful Spending: Prioritize needs over wants.

- Cut Unnecessary Expenses: Identify areas where you can reduce spending.

8. Protect Your Assets:

- Insurance: Have adequate insurance coverage for Health, Life, property, and vehicles.

9. Continuous Learning:

- Stay Informed: Keep up with financial news and trends.

- Seek Knowledge: Attend workshops, read books, or take online courses to improve your financial literacy.

10. Review and Adjust:

- Regular Check-ins: Periodically review your financial plan and make necessary adjustments.

- Be Flexible: Adapt your strategy as your circumstances change.

Remember, financial freedom is a journey, not a destination. By consistently following these steps and maintaining discipline, you can achieve your long-term financial goals.

The most important thing is continuous learning about ‘Financial Management’ & Here we will prepare you step by step to achieve your ‘Financial Freedom with LIC Agency’.

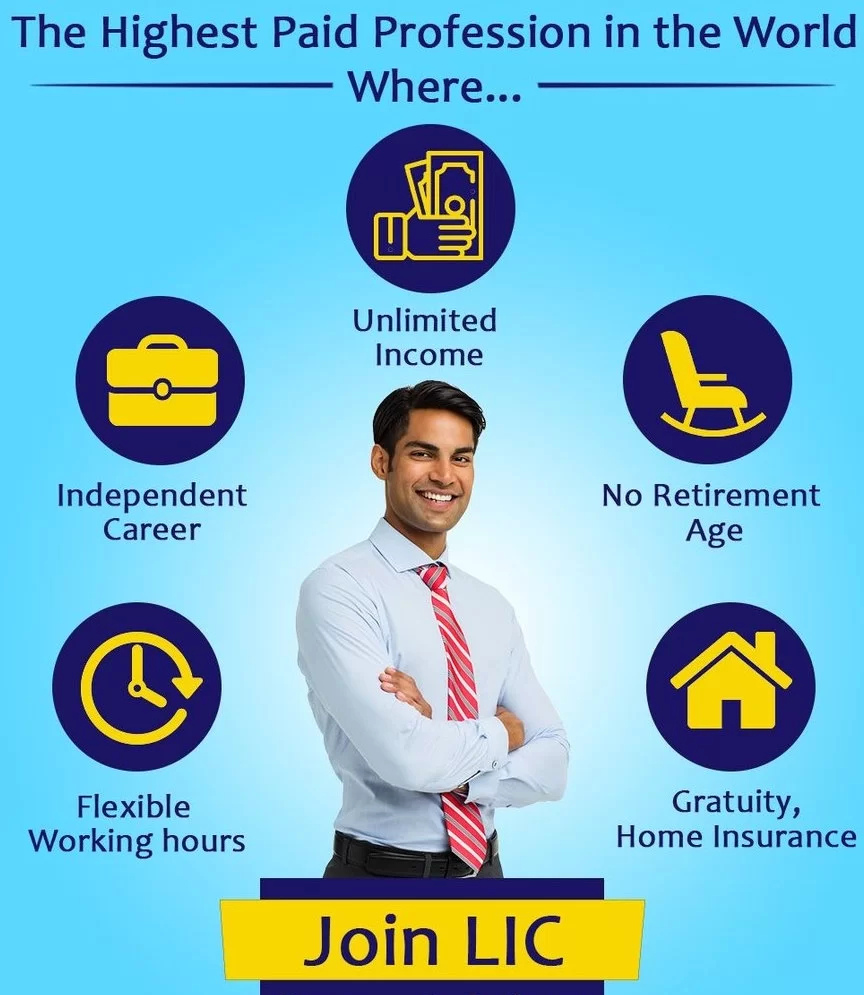

Why Should You Join LIC ?

LIC, the Life Insurance Corporation of India, is one of the Largest and most Reputable insurance companies in the country. Your LIC Agency Profile can lay you the solid Foundation for your ‘Financial Freedom’. Joining LIC as a life insurance agent can offer several benefits:

1. Brand Reputation and Trust:

- Established Name: LIC is a well-known and trusted brand in India. This can help you build credibility with potential clients.

- Customer Loyalty: LIC’s reputation often leads to customer loyalty, which can translate into repeat business and referrals.

2. Comprehensive Training and Support:

- Training Programs: LIC provides extensive training programs to equip agents with the knowledge and skills needed to succeed.

- Support Network: You’ll have access to a network of experienced agents and support staff who can provide guidance and assistance.

3. Lucrative Income Potential:

- Commission Structure: LIC offers competitive commission structures, allowing you to earn a substantial income based on your sales performance.

- Renewal/Passive Income: You can also earn residual income from policies you’ve sold, which can provide a steady stream of income in the long term.

4. Flexible Work Hours:

- Independence: As an LIC agent, you have the flexibility to set your own work hours and schedule appointments.

- Work-Life Balance: This can allow you to balance your professional and personal life effectively.

5. Career Growth Opportunities:

- Advancement: LIC offers opportunities for career advancement, including leadership roles and managerial positions.

- Recognition: You can also earn recognition and awards for your achievements.

6. Social Impact:

- Financial Security: By helping people secure their financial future, you can make a positive impact on their lives.

- Community Involvement: LIC often encourages agents to participate in community activities and social initiatives.

If you’re looking for a rewarding career with a reputable company, joining LIC as a life insurance agent could be a great option. However, it’s important to consider your own goals, interests, and skills before making a decision.

For Any Further Query Kindly Click Here.