“PM Bima-Sakhi Yojana” is a novel initiative by the Government of India, specifically designed for rural areas. Here’s a brief overview:

Key Features:

- Insurance Awareness: Bima Sakhi Yojana aims to create awareness about insurance products, especially in rural areas.

- Employment Opportunities: The scheme provides employment opportunities to rural youth, particularly women, as insurance agents or “Bima Sakhis.”

- Insurance Literacy: Bima Sakhis will educate people about various insurance products, helping them make informed decisions.

- Access to Insurance: The scheme aims to increase access to insurance products for rural populations, promoting financial inclusion.

Benefits

- Employment Generation: Bima Sakhi Yojana creates employment opportunities for rural youth.

- Insurance Awareness: The scheme promotes insurance awareness, helping people understand the importance of insurance.

- Financial Inclusion: Bima Sakhi Yojana increases access to insurance products for rural populations.

- Empowerment of Women: The scheme provides opportunities for women to become insurance agents, promoting women’s empowerment.

Implementation:

- Training and Support: Bima-Sakhis will receive training and support from insurance companies and the government.

- Technology Integration: The scheme will leverage technology to facilitate insurance sales, claims, and other processes.

- Monitoring and Evaluation: The government will monitor and evaluate the scheme’s progress, making adjustments as needed.

“PM Bima Sakhi Yojana” has the potential to transform the insurance landscape in rural India, promoting Financial Inclusion and Empowerment.

The “PM Bima Sakhi Yojana” offers several benefits, including:

- Economic Empowerment of Women: By providing training and employment opportunities as insurance agents, the scheme empowers women and contributes to their financial independence.

- Increased Insurance Penetration: The scheme aims to increase insurance awareness and penetration in rural and underserved areas, ensuring better financial security for individuals and families.

- Financial Security for Families: By acting as insurance agents, women can help families understand the importance of insurance and encourage them to secure their future through various insurance products.

- Skill Development and Training: The scheme provides comprehensive training to women on insurance products, sales techniques, and customer service, enhancing their skills and employability.

- Income Generation: The scheme offers a regular income to women through commissions and incentives earned from selling insurance policies.

- Social Impact: By promoting financial inclusion and empowering women, the scheme contributes to social development and reduces gender inequality.

- Permanent Employment: The Graduate Bima Sakhis will be given preference in future recruitment of Development Officers. However there will be some standard that needs to be followed like Age, Work Performance, Code of Conduct during Bima Sakhi Career etc.

Overall, the PM Bima Sakhi Yojana is a significant initiative that aims to empower women, promote financial security, and contribute to the overall development of the insurance sector in India.

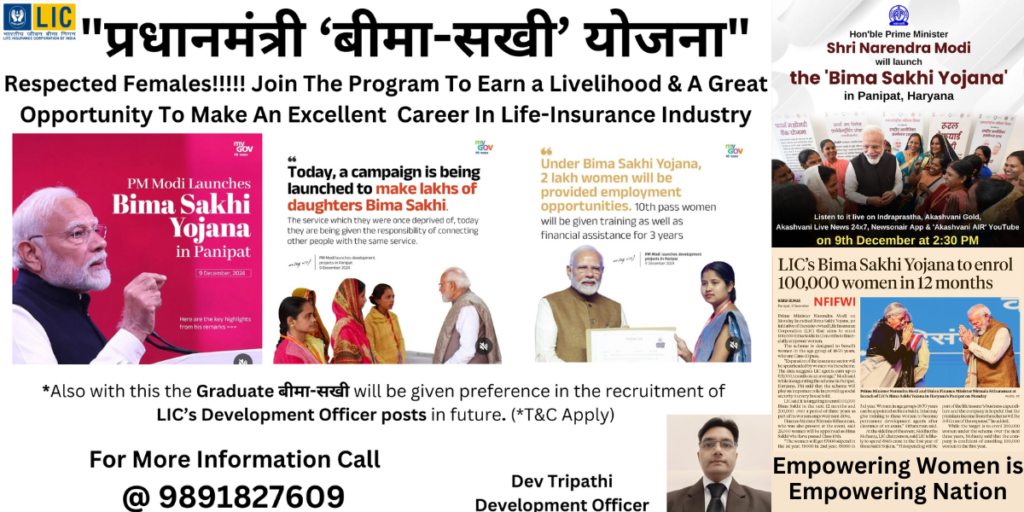

Prime Minister Shri Narendra Modi launches LIC’s Bima Sakhi Yojana

PM lays the foundation stone of the main campus of Maharana Pratap Horticultural University, Karnal

Our government has taken unprecedented steps for women empowerment in the last 10 years: PM

Today, India is moving forward with the resolve to develop by the year 2047: PM

To empower women, it is very important that they get ample opportunities to move forward and every obstacle in their way is removed: PM

Today, a campaign has started to make lakhs of daughters Bima Sakhis: PM

Posted On: 09 DEC 2024 8:44PM by PIB Delhi

The Prime Minister Shri Narendra Modi today launched the ‘Bima Sakhi Yojana’ of Life Insurance Corporation, in line with his commitment to women empowerment and financial inclusion, in Panipat, Haryana. During the occasion, he also laid the foundation stone of the Main campus of Maharana Pratap Horticultural University, Karnal. Addressing the gathering, Shri Modi said that today India was taking another strong step towards women empowerment. He added that today being the 9th day of the month was special as number 9 was considered auspicious in our scriptures and was associated with the nine forms of Nav Durga, worshipped during the Navratri. He remarked that today is also a day of worship of Nari Shakti.

The Prime Minister recollected that it was on 9th December, the first meeting of the Constituent Assembly was held and today when the country was celebrating 75 years of the Constitution, the date inspires us to ensure equality and holistic development.

Lauding Haryana as a great land that gave the world the knowledge of ethics and religion, Shri Modi was pleased that at this time, the International Gita Jayanti Mahotsav was also being held in Kurukshetra. He paid respects to the land of Gita and greeted all the patriotic people of Haryana. Shri Modi lauded the people of Haryana for adopting the mantra of ‘Ek hain to Safe hain’, which had become an example for the entire country.

Expressing his unflinching relationship and attachment with Haryana, the Prime Minister thanked the people for electing them to power for the third time in a row. He added that the newly formed state Government was being praised from all quarters despite being formed recently. He further added that the country has witnessed the way thousands of youth have got permanent jobs here without corruption after the formation of the government. Thanking the women of Haryana, Shri Modi remarked that he had launched the Bima Sakhi scheme, which provides employment to the women of the country and congratulated all for the same.

Recounting his privilege of launching the Beti Bachao, Beti Padhao campaign from Panipat, a few years ago, the Prime Minister underlined that it had a positive impact in Haryana as well as the entire country. He added that in Haryana alone, lives of thousands of daughters’ were saved in the last decade. Shri Modi remarked that now after a decade, the Bima Sakhi Yojana for sisters and daughters was being launched from this very land of Panipat. He added that Panipat had become a symbol of women power.

Highlighting that India was treading forward with the resolution of Viksit Bharat by 2047, Shri Modi said that from 1947 till today, the energy of every class and region has taken India to this height. He added that however, to achieve the resolution of a developed India by 2047, India needs many new sources of energy. North-East India being one such source, Shri Modi said Nari Shakti of India was another important source of energy in the form of women self-help groups, insurance sakhi, bank sakhi, agriculture sakhi which would bolster the resolution of developed India.

The Prime Minister stressed that it was imperative to ensure ample opportunities and remove every obstacle in their way to empower women. He added that when women were empowered, new doors of opportunities opened for the country. Highlighting that the Government opened up many jobs which were forbidden for women, Shri Modi remarked that the daughters of India were being deployed in the front lines of the army today. He added that India’s daughters, in large numbers, were becoming fighter pilots, recruited in police and heading corporate companies too. The Prime Minister noted that there were 1200 producer associations or cooperative societies of farmers and cattle rearers in the country, led by women. He added that girls were moving ahead in every field from sports to education. He further added that lakhs of daughters have also benefited from increasing the maternity leave for pregnant women to 26 weeks.

The Prime Minister remarked that the foundation of the Bima Sakhi programme, launched today, was also based on years of hard work and penance. Noting that most women lacked bank accounts after 6 decades of independence, he said that women were cut off from the entire banking system. Expressing pride over 30 crore women accounts under Jan Dhan Yojana, Shri Modi said that his Government opened the Jan Dhan accounts for women to ensure the subsidies like Gas subsidy reach the responsible hands of the family. He added that Jan Dhan Yojana has also helped in ensuring the transfer of money from schemes like Kisan Kalyan Nidhi, Sukanya Samridhi Yojana, funds to build own houses, funds to set up shops for hawkers, Mudra Yojana and others.

Lauding the women for having played a major role in providing banking facilities in every village, the Prime Minister said that those who did not even have bank accounts are now connecting the villagers to banks as Bank Sakhi. He added that the Bank Sakhis have started teaching people how to save money in a bank, how to get a loan and lakhs of such Bank Sakhis are providing services in every village today.

Recollecting that women of India were not insured earlier, Shri Modi remarked that today a campaign was started to make lakhs of women insurance agents or Bima Sakhi. He added that now women will also lead the expansion of sectors like insurance. The Prime Minister stressed that the target was to provide employment opportunities to 2 lakh women under the Bima Sakhi Yojana. He added that girls who had completed their class 10 would be trained and given financial help for three years under the Bima Sakhi Yojana. Citing data related to the insurance sector which showed that a LIC agent earns an average of 15 thousand rupees every month, Shri Modi said that our Bima Sakhis would earn more than 1.75 lakh rupees every year which would give additional income to the family.

Noting that the contribution of Bima Sakhis would be much more apart from earning money, the Prime Minister said ‘Insurance for All’ in India was the aim at the end of the day. He added that it was necessary for social security and to eradicate poverty from its roots. He further emphasised that the Bima Sakhis will strengthen the mission of Insurance for All.

Underlining that when an individual is insured, the benefit gained is immense, Shri Modi said the Government was implementing Pradhan Mantri Jeevan Jyoti Bima and Pradhan Mantri Suraksha Bima Yojanas. He added that an insurance of Rs 2 lakh was provided at a very low premium under these schemes. Shri Modi noted that more than 20 crore people of the country who could never even think of insurance, have been insured. He added that under these two schemes, a claim amount of about Rs 20 thousand crore has been given so far. Shri Modi remarked that Bima Sakhis would be working to provide social security cover to many families of the country, a kind of a virtuous work.

Emphasising that the revolutionary policies made for rural women in India in the last 10 years along with the policy decisions undertaken was indeed a subject of study, the Prime Minister said even though the titles of Bima Sakhi, Bank Sakhi, Krishi Sakhi, Pashu Sakhi, Drone Didi, Lakhpati didi sound simple and common, they are transforming the fate of India. He added that India’s Self Help Group Abhiyaan would be scripted in golden letters in history considering the empowerment of women done by it. Shri Modi remarked that the Government had made women self-help groups a big medium to bring about change in the rural economy. He added that 10 crore women across the country are associated with self-help groups and more than 8 lakh crore rupees of help to the women of self-help groups in the last decade.

Lauding the role and contribution of the women, associated with Self Help Groups across the country, as extraordinary, the Prime Minister remarked that they were working to make India the third largest economic power in the world. Noting that women from every society, class and family were associated with this, he added that every woman was getting opportunities in this. He further remarked that the movement of Self Help Groups was also strengthening social harmony and social justice. The Prime Minister highlighted that the Self Help Groups were not only increasing the income of one woman, but also increasing the confidence of a family, and the entire village. He lauded all of them for the good work being carried out.

Shri Modi also recounted his announcement made from the ramparts of Red Fort to make 3 crore Lakhpati Didis and so far more than 1 crore 15 lakh Lakhpati Didis have been made across the country. He added that these women have started earning more than one lakh rupees every year. The Prime Minister remarked that the Lakhpati Didi campaign was also getting much needed support from the Government’s Namo Drone Didi Yojana, which is discussed even in Haryana. Shri Modi narrated the account of a Namo Drono Didi from Haryana and said that this scheme was transforming both agriculture and the lives of women.

The Prime Minister highlighted that thousands of Krishi Sakhis were being trained to raise awareness about modern farming and natural farming in the country. He added that about 70 thousand Krishi Sakhis had already received certificates and these Krishi Sakhis had the capacity to earn more than 60 thousand rupees every year. Discussing about the Pashu Sakhis, Shri Modi said more than 1.25 lakh Pashu Sakhis are today a part of the awareness campaign about animal husbandry. He added that these were not just a means of employment but doing a great service to humanity. He remarked that Krishi Sakhis were not only working to save the earth for future generations, but also serving the soil and our farmers by spreading awareness about natural farming. Similarly, he added that our Pashu Sakhis were doing a pious work of serving humanity by serving animals.

Emphasising the love and affection received from the sisters and mothers of the country, Shri Modi said his Government built more than 12 crore toilets in the country in the last 10 years which helped many women whose houses had no toilets. Similarly, he added, free gas cylinder connections were given to crores of women who had no gas connection 10 years ago. He further added that tap water connections, pucca houses were also ensured to women who lacked them. The Prime Minister highlighted that the legislation ensuring 33 percent reservation for women in the Vidhan Sabha and Lok Sabha was also enacted. He added that the blessings of mothers and sisters would be ensured only when such honest efforts are made with the right intentions.

Touching upon the work being done for the welfare of the farmers by their Center and State Governments, the Prime Minister underscored that in the first two terms, the farmers of Haryana had received more than 1.25 lakh crore rupees as MSP, while after the formation of the government for the third time in Haryana, 14 thousand crore rupees was given to paddy, millet and moong farmers as MSP. He added that more than 800 crore rupees was also given to help drought affected farmers. Recounting the major role played by Chaudhary Charan Singh University in making Haryana the leader of Green Revolution, Shri Modi said that now in the 21st century, the role of Maharana Pratap University would be imperative in making Haryana a leader in the field of horticulture. He added that today, the foundation stone of the new campus of Maharana Pratap Horticulture University was laid and it would provide new facilities to the youth studying in this university.

Concluding his address, Shri Modi assured the women of Haryana that the state would develop rapidly and the Governments at the Centre and State would work three times faster in their third term. He expressed confidence that the role of women power in Haryana would continue to grow stronger.

The Governor of Haryana, Shri Bandaru Dattatreya, Chief Minister of Haryana, Shri Nayab Singh Saini, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman, Union Minister for Housing and Urban Affairs and Power, Shri Manohar Lal, Minister of State for Cooperation, Shri Krishan Pal and other dignitaries were present at the event.

In her welcome address, Smt. Sitharaman, while lauding the work done in the insurance sector by Life Insurance Corporation (LIC), said that LIC has come a long way from 2017, when there were 6 lakh women agents, which has now increased to 7.45 lakh agents in 2023.

Comparing the male-female ratio of insurance agents, the Union Finance Minister said that out of every 100 insurance agents, there are 28 female agents and the scheme Bima Sakhi Yojana, launched today by the Prime Minister, will be a step in the direction to improve women’s participation.

Smt. Sitharaman said, “The Bima Sakhi Programme, which the Prime Minister launched today, is also referred to as a women career agent programme. Under this initiative, 25,000 women will be appointed as Bima Sakhis.”

To participate in the initiative, women aged between 18 and 70 years who have completed their 10th-grade education are eligible to apply.

She stated, “Each Bima Sakhi will earn a monthly stipend of Rs. 7,000 in the first year, Rs. 6,000 per month in the second year, and Rs. 5,000 per month in the third year. This stipend serves as a basic support allowance. Additionally, women agents can earn commissions based on the insurance policies they secure, with their earnings increasing in proportion to the business they bring in.”

This creates an opportunity for women to significantly increase their income based on their performance.

In addition to the stipend, Smt. Sitharaman said that Bima Sakhis will earn commissions based on the insurance policies they secure.

The Government aims to recruit 2 lakh Bima Sakhis over the next three years; besides women aged between 18 to 70 years can apply under this programme, the Union Finance Minister added.

Background

The ‘Bima Sakhi Yojana’ initiative of Life Insurance Corporation of India (LIC) is designed to empower women aged 18-70 years, who are Class X pass. They will receive specialized training and a stipend for the first three years to promote financial literacy and insurance awareness. After training, they can serve as LIC agents and the graduate Bima Sakhis would have the opportunity to qualify for being considered for Development Officer roles in LIC.

The Main campus of Maharana Pratap Horticultural University, Karnal and six regional research stations, spread over 495 acres, will be established at a cost of over Rs 700 crore. The University will have one College of Horticulture for Graduate and Post-Graduate studies and five schools covering 10 horticulture disciplines. It will work towards crop diversification and world class research for development of horticulture technologies.