Insurance News Updates

LIC Set To Enter Health Insurance Sector

The National Insurer Life Insurance Corporation (LIC) will soon announce its foray into the health insurance sector, with ambitions to become a significant player, a top official has said.

The insurance industry, especially life insurers, had been anticipating government amendments to the Insurance Act that would introduce a composite licensing regime, allowing life insurers to offer non-life products, including the highly lucrative health policies.

At present, the domestic insurance industry consists of 70 players, with nearly half a dozen being standalone health insurers and the rest offering life and general insurance products.

Many Western countries have adopted the composite licensing model, which was allowed in India until 2016, when the Insurance Regulatory and Development Authority of India (IRDAI) prohibited life insurers from providing general and health products.

LIC first revealed its health insurance plans this May, expressing interest in acquiring a majority stake in an existing health insurer to gain an early advantage rather than starting from scratch. “We want to be a large and serious player in the health insurance segment,” Chief Executive Siddhartha Mohanty told TNIE in a recent interaction. “We are sure we can make it really big because the market is very huge,” he added.

Reiterating the company’s preference for acquiring a stake rather than launching a new entity, Mohanty said, “We will be buying a large stake in an existing health insurance company, and we are working hard on that. Hopefully, soon we will have an announcement to make on that front.”

In February, a parliamentary panel recommended establishing a composite insurance licensing regime to reduce costs and ease the compliance burden for insurers. Currently, life insurance companies are limited to offering only long-term health benefits. An amendment to the Insurance Act would be necessary to allow them to provide hospitalisation and indemnity coverage.

India’s insurance market remains significantly under-penetrated. Life insurance penetration stands at less than 5 percent, while health insurance coverage reaches approximately 60 percent, or around 650 million people. Of these, 350 million are covered under government-sponsored programmes, and around 200 million have group insurance coverage.

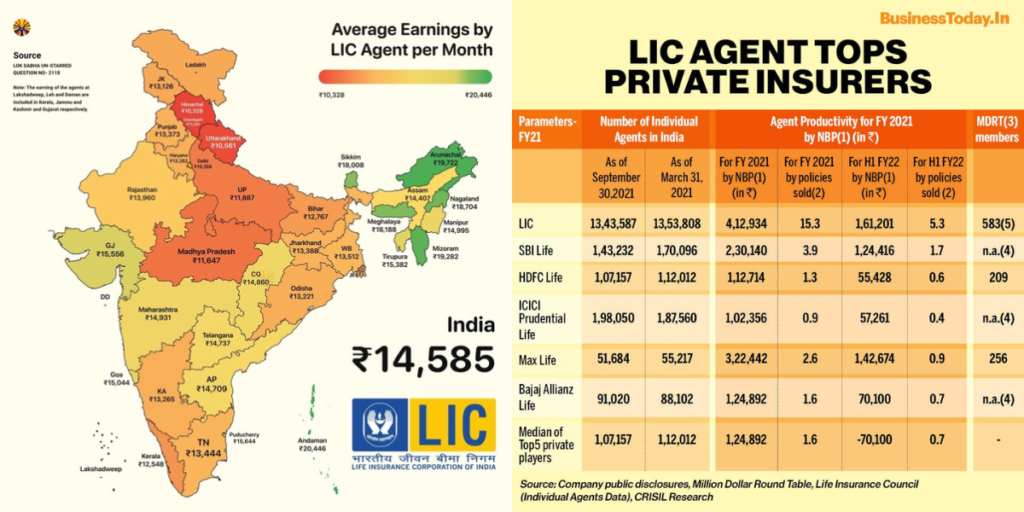

The government and IRDAI are eager to expand health insurance coverage, aiming for universal coverage by 2047. LIC’s entry into the health insurance market is expected to boost these efforts, given the corporation’s strong brand presence and its extensive sales force of over 1.3 million.

For the Financial Year ending in March 2024, LIC reported a net profit of Rs 40,676 crore, up from Rs 36,397 crore in the previous fiscal year. The Total Premium Income for the year was Rs 4,75,070 crore, compared to Rs 4,74,005 crore in March 2023.

LIC Earmarks Rs 600 Crore For Digital Shift; To Be ‘Paperless’ in 2 years

LIC Launches Single-Premium Micro-Term Insurance For Financial Groups

Life Insurance Firms Report 14% Growth In New Biz Premiums In Sept’ 24

LIC Drives New Biz Premium Growth of Life Insurance Companies in July’ 24

LIC Regains Market in New Business Premium; Private Peers Cede Ground

LIC Outperforms Private Peers in New Premium Mop-Up in August’ 24

LIC Agents Earn Rs.10k/Month in HP, Rs.20k/Month in Andaman & Nicobar

LIC को लेकर आई बड़ी खबर, 13 लाख लोगों से जुड़ा है मामला

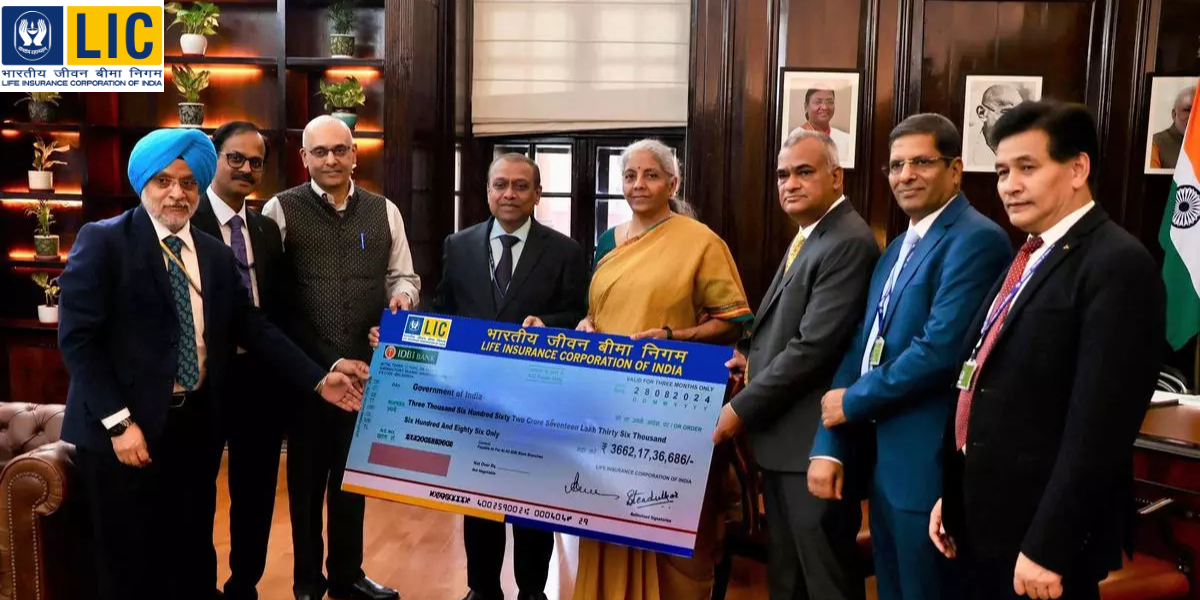

Indian Government Gets Rs 3,662 Crore As Dividend From LIC For FY-2023-24

LIC Q1 FY25 Results: Net Profit Increases 9.6% To Rs 10,461 Crore

LIC’s New Business Premium For Aug. Registers 35% Increase YoY to Rs 19,309 Cr

LIC Launches Project ‘Jeevan Samarth’ To Meet Customers’ Evolving Needs

Life Insurance Premiums Rise 14% in July 24

LIC Introduces Term Insurance Products For The Young India

LIC हेल्थ इंश्योरेंस पॉलिसी भी बेचेगी! क्या है कंपनी का प्लान, सीईओ ने किया खुलासा

LIC May Enter Indemnity Health Insurance By Buying Stand-Alone Private Insurer : CEO

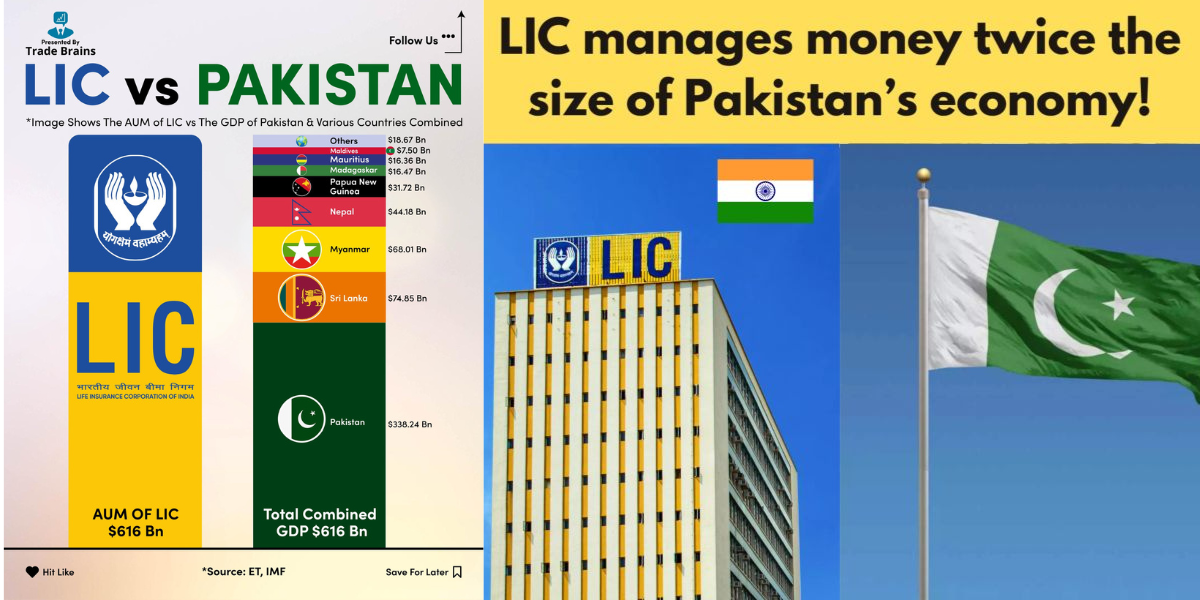

Big Daddy LIC Manages Money Nearly Double The Size of Pakistan’s Economy

LIC Manages Money Nearly 2x The Size of Pak Economy, Higher Than Denmark & Singapore’s GDP Too

LIC World’s Strongest Insurance Brand: Brand Finance Insurance Report