LIC Plans

Table of Contents

Toggle

LIC has consistently evolved its product offerings to cater to the diverse needs of the Indian population. Here’s a look at how they’ve customized their products:

Traditional Products:

- Endowment Plans: These provide life cover and maturity benefits, often with tax benefits. LIC offers various endowment plans with flexible premium payment terms and maturity periods.

- Term Plans: Pure protection plans offering high life cover at affordable premiums. LIC provides term plans with various features like accidental death cover, critical illness riders, and return of premium options.

- Pension Plans: These plans help secure a regular income post-retirement. LIC offers pension plans with guaranteed returns, market-linked options, and flexible payout choices.

Modern Products:

- Unit-Linked Insurance Plans (ULIPs): These combine life insurance with investment in market-linked funds. LIC offers ULIPs with various investment options, fund switching facilities, and partial withdrawal options.

- Child Plans: These plans help secure your child’s future education and other needs. LIC offers child plans with maturity benefits, regular income options, and life cover for the parent.

- Health Insurance Plans: These plans cover medical expenses arising from illnesses or accidents. LIC offers health insurance plans with comprehensive coverage, cashless hospitalization, and add-on benefits.

- Other Initiatives:

- Customer Service: LIC has a strong network of branches and customer service centers across India to provide personalized assistance.

- Financial Advisors: LIC has a team of trained financial advisors who can help customers choose the right product based on their needs and risk profile.

By continuously adapting to the changing needs of the Indian population, LIC has solidified its position as a trusted and reliable financial partner

Section (A)-Products For Wealth Creation

When The Future Prospects of Indian Economy are Bright in Global Arena Then Why To Be Dependent on Traditional Investment Avenues with Conservative RoI? Welcome to ‘The Equity Investing’ with Trust of Your Own LIC of INDIA. Here You Will Not only Beat Inflation But also You will Be Able to Grow Your Capital.

(a) NIVESH PLUS

Here are the key USPs of LIC Nivesh Plus:

Investment Flexibility:

- Choice of Funds: You can choose from four different investment funds to align your risk appetite and investment goals.

- Fund Switching: You have the option to switch between funds to adapt to changing market conditions.

Life Cover:

- Comprehensive Protection: The plan provides life cover throughout the policy term, ensuring financial security for your loved ones in case of unfortunate events.

Tax Benefits:

- Section 80C: Premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act.

Single Premium:

- Convenience: You only need to pay a single premium at the beginning of the policy term, making it a hassle-free investment option.

Potential for High Returns:

- Market-Linked Returns: By investing in market-linked funds, you have the potential to earn higher returns compared to traditional fixed-income instruments.

Lower Charges:

- Cost-Effective: The plan levies lower charges compared to other ULIPs, maximizing your returns.

- Mortality Charges waiver: On Maturity Date The Whole Mortality Charge Will Be Waived. Hence in a sense You get Free Life Cover.

For Any Further Query Click Here.

(b) INDEX PLUS

The Great Way To Build Wealth is Through ‘INDEX INVESTING’. Here Comes The LIC’s ‘INDEX PLUS’ That Fulfills Aspiration of GenZ Who Loves To do ‘Passive Investment’ Which secures their Future Without Compromising the Enjoyment of Today.

LIC Index Plus is a Unit-Linked Insurance Plan (ULIP) that offers the following unique selling points (USPs):

Investment Flexibility:

- Choice of Funds: You can choose from a variety of investment funds based on your risk appetite and investment goals.

- Fund Switching: You can switch between funds to align with market conditions and your investment strategy.

- Partial Withdrawals: You can make partial withdrawals to meet your financial needs without disrupting your investment goals.

Life Cover:

- Comprehensive Life Cover: The plan provides life cover throughout the policy term, ensuring financial security for your loved ones.

- Guaranteed Additions: You receive guaranteed additions at specified policy durations, providing a certain level of returns.

Tax Benefits:

- Tax Deduction: Premiums paid towards the policy are eligible for tax deductions under Section 80C of the Income Tax Act.

- Tax-Free Maturity Benefits: Maturity benefits are generally tax-free, subject to applicable tax laws.

Additional Features:

- Optional Rider: You can enhance your coverage with the optional Accidental Death Benefit Rider.

- Online Portal: You can manage your policy online through LIC’s user-friendly portal.

- Strong Brand Reputation: LIC is a trusted and reliable brand with a long history of providing financial solutions to Indians.

Section (B) - Term Insurance Policies

Why Term Insurance ?

Term Insurance is a cost-effective way to protect your family’s financial future in case of your untimely death. Here are some reasons why you should consider taking term insurance:

- Financial Protection: Term insurance provides a lump sum death benefit to your family, which can be used to cover expenses such as outstanding loans, children’s education, and daily living costs.

- Income Replacement: The death benefit can act as a replacement for your lost income, ensuring your family’s financial stability.

- Affordable Premiums: Term insurance offers high coverage at relatively low premiums, making it accessible to most people.

- Tax Benefits: Premiums paid towards term insurance are often tax-deductible, providing additional financial savings.

- Peace of Mind: Knowing that your family is financially secure in your absence can provide you with peace of mind.

It’s important to choose a term insurance plan that suits your specific needs and budget. Consider factors such as the coverage amount, policy term, and any additional riders you may want to include

Why Term Insurance From LIC of INDIA ?

Here are reasons why “LIC Term Policies” are considered better than private players:

Advantages of LIC Term Policies :

1. Trust and Reliability: LIC is a government-owned entity with 65+ years of experience.

2. High Claim Settlement Ratio: LIC’s claim settlement ratio is consistently high (98.52% in 2024-25).

3. Low Premium Rates: LIC offers competitive premium rates.

4. Wide Range of Plans: LIC offers various term plans to suit different needs.

5. Flexibility: Options for policyholders to customize plans.

6. Government Backing: “Sovereign Guarantee” for policyholders’ funds.

7. No Hidden Charges: Transparent policy terms and conditions.

Comparison with Private Players :

LIC

1. Claim Settlement Ratio: 98.62% Plus High In Volume/Absolute Term Both Number of Policies & Value.

2. Premium Rates: Competitive

3. Trust Factor: High (Govt.-Owned)

4. Branch Network: Extensive (2,000+ branches)

Private Players (e.g., HDFC Life, ICICI Prudential, SBI Life)

1. Claim Settlement Ratio: 95-97%(But Less in Volume/Absolute Term)

2. Premium Rates: Comparable to LIC

3. Trust Factor: Lower than LIC

4. Branch Network: Smaller than LIC

Key Benefits of LIC Term Policies

1. Financial Security for Family

2. Affordable Premiums

3. Flexibility in Policy Terms

4. Tax Benefits (Section 80C and 10(10D))

5. High Claim Settlement Ratio

Popular LIC Term Plans:

1. LIC Yuva Term Plan

2. LIC Yuva Credit Life Plan

3. LIC New Jeevan Amar Plan

Why Choose LIC Term Policies?

1. Stability and Trust

2. Comprehensive Product Portfolio

3. Competitive Pricing

4. Excellent Customer Service

5. Government Backing

While private players offer competitive features, LIC’s trust factor, high claim settlement ratio, and government backing make its term policies attractive to many policyholders.

(a) LIC's Yuva Term Plan - Protecting The Young India

India is The Youngest Nation in The World Because of it’s ‘Demographic Dividend‘ i’e High Proportion of Youth Population in the Age Bracket of 15 Year to 64 Year. The major Chunk of this group belongs to the youth of Age Group 18 yrs to 45 yrs. To Cover This Age Group, LIC Of India Brings Yuva Term Plan.

LIC’s Jeevan Yuva Term Plan (Table No. 825) is a popular term insurance plan with the following Unique Selling Points (USPs):

Key Features:

1. Affordable Premiums

2. High Life Cover at Low Cost

3. Flexible Policy Term (10-60 years)

4. Option to increase cover up to 5cr.

5. Accidental Death Benefit Rider (optional)

6. Critical Illness Rider (optional).

USPs:

1. Level Premiums: Premiums remain same throughout policy term.

2. Increasing Death Benefit: Death benefit increases by 5% every year.

3. Flexible Premium Payment Options: Annual, Semi-Annual, Quarterly, Monthly.

4. Tax Benefits: Section 80C and 10(10D) benefits.

5. Grace Period: 30 days for premium payment.

6. Revival Option: Policy can be revived within 5 years.

7. Premium Rebates For Higher Sum Assured.

Benefits:

1. Death Benefit: Nominee receives sum assured.

2. Maturity Benefit: None (pure term plan).

3. Accidental Death Benefit: Additional Sum Assured(Optional).

4. Critical Illness Benefit: Lump sum on diagnosis.

Eligibility:

1. Age: 18-45 years.

2. Policy Term: 10-60 years.

3. Sum Assured: 50 lakhs – 500 lakhs(5cr).

Premium Rates:

As Per Age & Medical Conditions .

Why Choose LIC Jeevan Yuva Term Plan?

1. Affordable & Competitive Low Premiums

2. Increasing Death Benefit with ADDB Rider.

3. Flexible policy term

4. Option to add more riders

5. Government-backed security

This plan provides financial protection to policyholders’ families at an affordable cost.

For Any Further Query Please Click Here.

(b) LIC's Yuva Credit Life Insurance Plan

Now Live Your Life Freely Without Worry of Your Debt Payment By Taking The Protection Cover of LIC’s Yuva Credit Life Insurance Plan i’e Your MRI – Mortgage Redemption Insurance Plan.

The LIC’s Yuva Credit Life Insurance Plan (Table No. 825) is a ‘Decreasing Term Insurance’ plan designed to cover loan liabilities. Here are its Unique Selling Points (USPs):

Key Features:

1. Decreasing Sum Assured: Reduces as loan liability decreases (MRI – Mortgage Redemption Plan)

2. Level Premiums: Premiums remain same throughout policy term.

3. Flexible Policy Term: 5-30 years.

4. Accidental Death Benefit Rider (optional).

5. Critical Illness Rider (optional).

USPs:

1. Loan Protection: Covers outstanding loan amount in case of policyholder’s demise.

2. Decreasing Sum Assured: Aligns with reducing loan liability.

3. Flexible Premium Payment Options: Annual, Semi-Annual, Quarterly, Monthly.

4. Tax Benefits: Section 80C and 10(10D) benefits.

5. Loan Facility: Up to 80% of surrender value.

6. Grace Period: 30 days for premium payment.

7. Revival Option: Policy can be revived within 2 years.

Benefits:

1. Death Benefit: Nominee receives outstanding loan amount.

2. Maturity Benefit: None (pure term plan).

3. Accidental Death Benefit: Additional sum assured.

4. Critical Illness Benefit: Lump sum on diagnosis.

Eligibility:

1. Age: 18-45 years.

2. Policy Term: 5-30 years.

3. Sum Assured: ₹50 Lakh- ₹5.0 Cr.

Premium Rates:

As per Age, Sum Assured & Medical Conditions.

Why Choose LIC Yuva Credit Life Insurance Plan?

1. Protection for Loan Liabilities

2. ‘Decreasing Sum Assured’ aligns with Loan Repayment.

3. Flexible policy Term & available in Single & Regular Premium Payment Options.

4. Optional Riders for added protection

5. Government-Backed security.

This plan provides financial security to policyholders’ families by covering outstanding loan liabilities.

For Any Further Query Please Click Here.

Section (C) - Whole Life Insurance Plans

Why Whole Life Plans ?

Here are some of the key USPs of Whole Life Insurance Plans:

- Lifetime Coverage: Whole life insurance provides coverage for your entire life, unlike term life insurance which has a specific term. This ensures financial security for your loved ones even after you’re gone.

- Cash Value Accumulation: A portion of your premium goes towards building a cash value within the policy. This cash value grows over time and can be accessed through loans or withdrawals, subject to terms and conditions.

- Tax Advantages: The cash value in a whole life policy grows tax-deferred, meaning you won’t owe taxes on the growth until you withdraw it. Additionally, death benefits are generally tax-free to beneficiaries.

- Fixed Premiums: Unlike some other life insurance policies, whole life insurance typically has fixed premiums, meaning your monthly or annual payment won’t change over the life of the policy.

- Additional Benefits: Some whole life policies offer additional features like riders that can provide extra coverage for specific needs, such as critical illness or long-term care.

LIC Whole Life Plans offer numerous benefits, including:

Key Benefits:

- Lifetime Coverage: Protection until age 100.

- Savings Component: Accumulation of cash value.

- Guaranteed Death Benefit: Nominee receives sum assured.

- Maturity Benefit: Policyholder receives sum assured at maturity (age 100).

- Bonus Eligibility: Participates in LIC’s profits.

- Loan Facility: Up to 80% of surrender value.

- Tax Benefits: Section 80C and 10(10D) benefits.

Additional Benefits:

- Accidental Death Benefit Rider (optional)

- Critical Illness Rider (optional)

- Disability Benefit Rider (optional)

- Waiver of Premium Rider (optional)

- Income Benefit Rider (optional)

Advantages:

- Long-term financial security

- Forced savings discipline

- Protection for family

- Potential for bonus earnings

- Flexibility in premium payment

- Option to add riders for enhanced protection

- Government-backed security

Popular LIC Whole Life Plans:

- LIC Jeevan Umang (Table No. 745)

- LIC Jeevan Utsav (Table No. 771)

Eligibility:

- Age: 30 Days-65 years (Varies by Plan)

- Policy Term: Lifetime (up to the age of100)

- Sum Assured: ₹2Lakh/5 Lakh – No upper Limit (Varies by Plan)

Why Choose LIC Whole Life Plans?

- Lifetime protection

- Savings component

- Guaranteed death benefit

- Bonus eligibility

- Government-backed security

- Flexibility in premium payment

- Option to add riders

LIC Whole Life Plans provide comprehensive protection and savings, making them a popular choice for long-term financial planning.

Would you like more information on specific plans, premium rates, or comparisons with other insurance products?

The Best Birthday GIFT For Your Newly Borne Child (30 Days Old)

LIC Jeevan Umang (Table No.745) is a whole life insurance plan with the following Unique Selling Points (USPs):

Key Features:

1. Lifetime Coverage: Protection up to age 100.

2. Guaranteed Death Benefit: Nominee receives sum assured.

3. Maturity Benefit: Policyholder receives sum assured at age 100.

4. Bonus Eligibility: Participates in LIC’s profits.

5. Loan Facility: Up to 80% of surrender value.

USPs:

1. Whole Life Coverage with Limited Premium Payment Term (15-30 years).

2. Guaranteed Benefits, Increasing Risk Cover and Maturity Benefit.

3. 8% Annual Interest on Sum Assured Lifetime.

4. Participation in LIC’s Profits through Bonus.

5. Flexible Premium Payment Options (Annual, Semi-Annual, Quarterly, Monthly).

6. Option to Add Riders for Enhanced Protection.

7. Tax Benefits under Section 80C and 10(10D).

8. Government-Backed Security( Sovereign Guarantee ).

Benefits:

1. Death Benefit: Nominee receives sum assured + bonus.

2. Maturity Benefit: Policyholder receives sum assured + bonus.

3. Survival Benefit: 8% of sum assured every year after PPT ends.

4. Loan Facility

5. Bonus: Participates in LIC’s profits.

Eligibility:

1. Age: 30 days -55 years.

2. Policy Term: Lifetime (up to age 100).

3. Premium Payment Term: 15-30 years.

4. Sum Assured: ₹2 lakhs – No Limit.

Why Choose LIC Jeevan Umang?

1. Lifetime protection

2. Guaranteed death benefit and maturity benefit

3. Bonus eligibility

4. Flexible premium payment options

5. Government-backed security

6. Tax benefits

7.Taxfree Survival benefit Lifetime

8. Best For The Newly Borne Children.

LIC Jeevan Umang provides comprehensive protection and savings, making it a popular choice for long-term financial planning.

Would you like more information on LIC Jeevan Umang or comparisons with other insurance products?

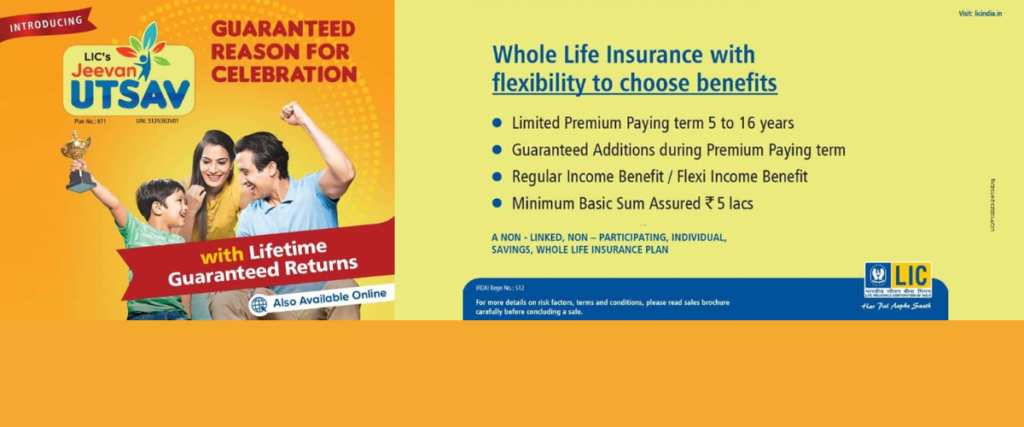

The Best Birthday GIFT For Your Newly Borne Child (90 Days Old)

LIC Jeevan Utsav T-771 is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan offered by the Life Insurance Corporation of India (LIC). It provides financial protection for your family in case of unfortunate demise and also offers survival benefits.

Key Features:

- Limited Premium Payment Term: You can choose a premium payment term of 5 to 16 years, making it convenient to manage your finances.

- Guaranteed Benefits: The plan offers guaranteed benefits, including death benefits and survival benefits, providing financial security.

- Flexible Income Options: You can choose between Regular Income Benefit or Flexi Income Benefit, allowing you to tailor the plan to your specific needs.

- Tax Benefits: Premiums paid and benefits received may be eligible for tax benefits under applicable tax laws.

Benefits:

- Death Benefit: In case of the policyholder’s unfortunate demise, a lump sum death benefit is paid to the nominee along with accrued guaranteed additions.

- Survival Benefits: Depending on the chosen option, you can receive regular income or flexible income benefits for your lifetime.

Eligibility & Features –

Age : 90 Days – 65 Years

Premium Paying Term (PPT) : 5 Year – 16 Year

Sum Assured : 5 Lakh – No Upper Limit.

Riders – ADDB(Accidental Death & Disability Benefit Rider)- Up To The Age of 70 Years.

Survival Benefit : 10% of The Sum Assured Will Be Paid To The Policyholder Every Year(Whole Life).

Death Benefit : Basic Sum Assured + Bonus Accrued Till Date.