I-Introduction

Table of Contents

Toggle

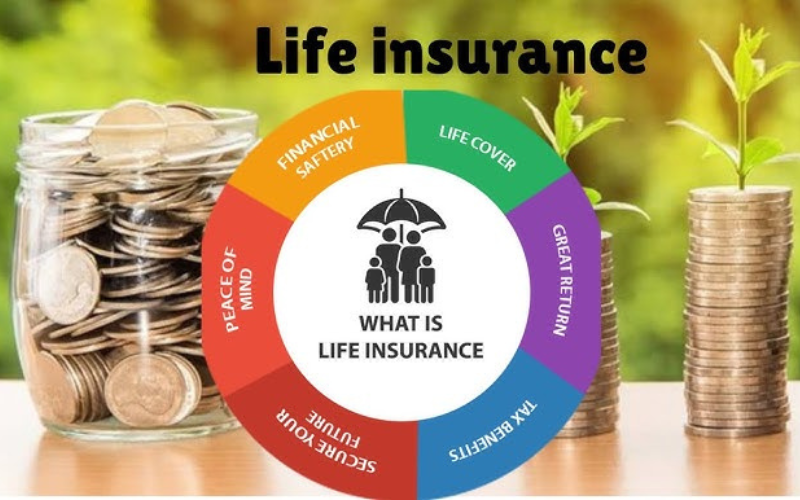

‘Life Insurance’ is a ‘Financial Contract’ between an Insurance Company(LIC) and an Individual. The Insurer(LIC) promises to pay a sum of money (Death Benefit = Sum Assured) to the Beneficiary upon the insured person’s Untimely death. In return, the insured pays regular premiums. This provides ‘Financial Security’ to the family or dependents in case of an untimely death.

Life insurance can also offer additional benefits like savings Survival Benefits and investment options in policies like ULIPs, Whole Life Insurance Plans etc. However there are policies with return of purchased price, in case of no claim arisen during the policy term.

II-What is Life Insurance & How it Works?

As said earlier ‘Life Insurance’ is a contract Between an Insurance Company (Insurer i’e LIC of INDIA) and an Individual (Policy holder/Insured), under which Insurer provides ‘Financial Security’ to the Nominee/Beneficiary in case of untimely demise of the policy holder. As name suggest, Life Insurance is concerned with the eventualities associated with Life e,g Disability, Death etc.

The person who is fit & fine can Take Life Insurance as a protection / Financial Shield for his family & Loved Ones. With the drastic changes in society, Insurance products are also customized as Need Based Financial Products(We will Talk about it later on).

Working System Of Life Insurance –

Here’s how it works:

- Policyholder: The individual who purchases the life insurance policy.

- Insurer: The insurance company providing the coverage.

- Premium: The regular payments made by the policyholder to the insurer.

- Death Benefit: The lump sum amount paid to the beneficiary upon the policyholder’s death.

- Beneficiary: The person(s) designated to receive the death benefit.

Life insurance can be categorized into two main types:

- Term Life Insurance: Provides coverage for a specific period (Term). If the insured survives the term, no death benefit is paid.

- Permanent Life Insurance: Offers lifelong coverage with a savings component. It includes options like whole life insurance and universal life insurance.

Life insurance can help protect your loved ones’ financial future, cover debts, fund education expenses, or provide a financial cushion in case of unexpected circumstances.

III-Benefits of Life Insurance

Taking Life Insurance of Your life is the First Important Step towards & Fundamental Principle of ‘Financial Freedom’. the Other Benefits Are –

– Financial Security for loved ones in the event of death

– Income Replacement

– Paying off Debts and Mortgages

– Future Expenses

– Tax Benefits

– Business Protection (Buy-Sell Agreements, Key-Man Insurance)

– Supplemental retirement income

– Protecting Your Family’s Financial Future

– Ensuring Business Continuity

– Retirement Planning

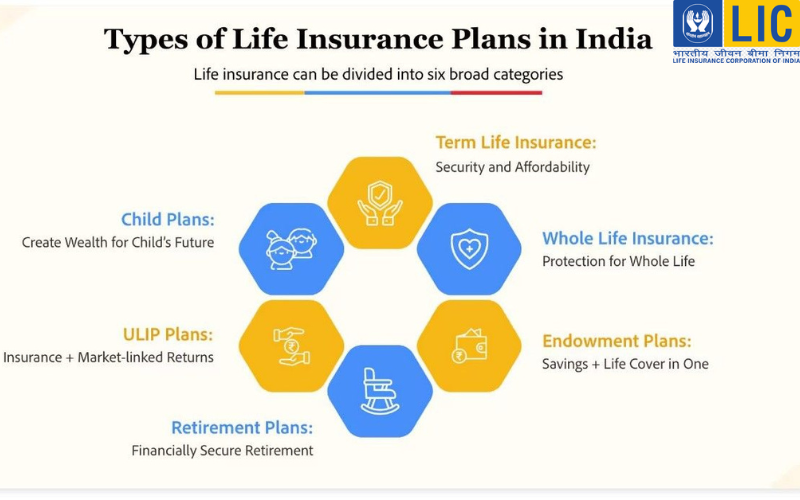

IV-Types of Life Insurance Policies

As per the modern needs In India there are following Life Insurance Products popular among our Citizens.

– Term Life Insurance=> The Real/True Form of Life Insurance

– Whole Life Insurance => Once Insured is Always Insured.

– Universal Life Insurance => The Variable of whole Life Plan.

– Variable Life Insurance => It’s Also Called MRI–Mortgage Redemption Insurance Plan (It’s Taken Against Home Loans, Business Loans etc)

– Indexed Universal Life Insurance

– Group Life Insurance

-Employer-Employee Scheme.

Note- For More Information about each Category Plans Kindly visit our Product Page from the Menu.

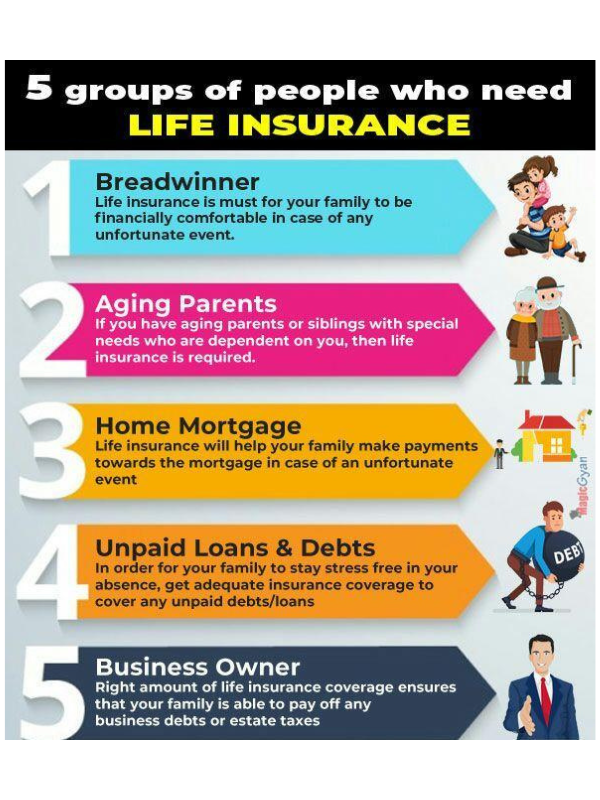

V. Who Needs Life Insurance?

Basically People having ‘Insurable Interests’ Can take Life Insurance Following Category people Must take Life Insurance Policies on Their Lives – – Working individuals with dependents

– Business owners

– Stay-at-Home Parents (Aged Parents).

– Retirees

– Individuals with significant debt (Home Loan, business Loan, Personal Loan etc.)

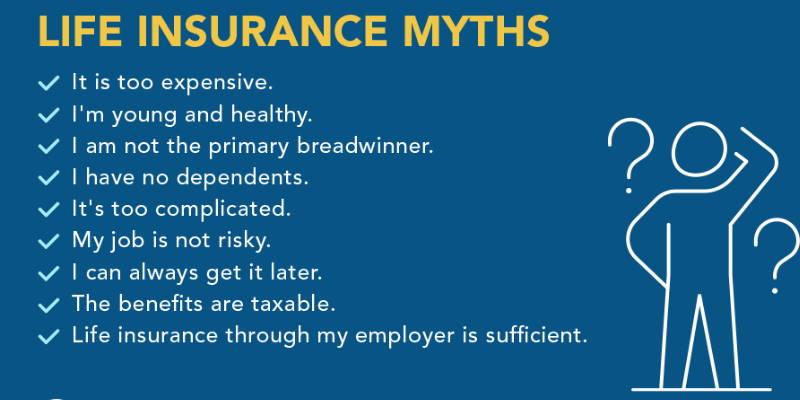

VI-Common Misconceptions About Life Insurance

‘Financial Security’ comes from the mindset of a ‘Financial Security’. In Indian Society There is a major problem of not thinking too much about ‘Financial Future’. The reason is being that in old days people used to live together & with that togetherness people never felt the burden of problems because people used to share the problems.

With generation by generation this carelessness some how ingrained in our DNA & Mindset due to which although nuclear family system being prevalent but People either don’t pay heed on ‘financial Security’ or it comes as last priority. They are fond of purchasing Luxury first & Financial Planning, Life Insurance, Health Insurance etc as last resort. However COVID-19 Pandemic taught people the importance of Life Insurance, Health Insurance, etc.

There are some common misconception towards Taking ‘Life Insurance’ :

– “I’m too young to need life insurance”

– “Life insurance is too expensive”

– “I have Enough Savings, I don’t need life insurance”

– “Life insurance is only for Breadwinners”.

If You have either of them any misconception, you should remember the COVID-19 Pandemic Situation & Lockdown that lasted for more that 2 years.

VII-How to Choose the Right Life Insurance Policy

HLV – Human Life Value is a concept that illustrates how much coverage will you need to protect the ‘Financial Security’ of your family. According to it a person in different age group needs different amount of ‘Life Insurance Coverage’, For example-

For Age Group 18 yr – 35 yr HLV = 25 x Gross Remuneration (GR)

For Age Group 36 yr – 45 yr HLV = 20 x GR

For The Age Group 46 yr– 50 yr HLV = 15 x GR

For The age Group 51 yr – 60 yr HLV = 10 x GR.

However there are few other factors need to be considered before opting proper Insurance Coverage.

– Determine your needs (income replacement, debt repayment)

– Calculate your coverage amount

– Choose a policy type (term, whole, universal)

– Consider riders and add-ons (waiver of premium, accelerated death benefit)

– Research insurance companies (Claim Settlement Ratio Track Record).

Key-Man Insurance : The Shield For Your Business Protection

Key Man Insurance : Safeguarding Your Business’s Backbone

A key man is an individual whose contribution to a company is irreplaceable. Their loss can significantly impact the business’s profitability, growth, and even its survival. Key man insurance is a life insurance policy designed to protect businesses from the financial consequences of losing such a critical employee.

How Key Man Insurance Works

- Policyholder: The company itself is the policyholder.

- Insured Person: The key employee whose life is insured.

- Premium Payment: The company pays the premiums for the policy.

- Claim Payment: In the unfortunate event of the key person’s death, the insurance company pays the death benefit to the company.

Benefits of Key Man Insurance

- Financial Protection: The death benefit received can be used to cover various expenses like:

- Hiring and training a replacement.

- Repaying loans or debts.

- Maintaining business operations during a transition period.

- Business Continuity: The policy ensures that the business can continue to operate smoothly, minimizing disruptions.

- Investor Confidence: It demonstrates the company’s proactive approach to risk management, reassuring investors and lenders.

- Tax Benefits: In many jurisdictions, premiums paid for key man insurance are tax-deductible.

Key Considerations

- Identifying Key Persons: Clearly define who constitutes a key person based on their role, skills, and impact on the business.

- Adequate Coverage: Determine the appropriate sum assured to cover potential losses, considering factors like recruitment costs, lost revenue, and business disruption.

- Policy Term: Choose a policy term that aligns with the key person’s expected tenure with the company.

- Regular Review: Periodically review the policy to ensure it remains adequate and relevant to the company’s evolving needs.

Key man insurance is a valuable tool for businesses to protect themselves from the financial risks associated with the loss of a key employee. By understanding its benefits and carefully considering its implications, companies can safeguard their future and ensure business continuity.

VIII-Important Statistics

- According to Swiss Re Institute Report (2024), the overall ‘Insurance Penetration’ in 2023-24 is expected to be at 3.8% in INDIA and 6.5 % Globally. Penetration for life Insurance in India for the year is projected to be at 2.9 %, and 1% for non-life.

- Insurance Penetration = (Total Insurance Premium Collected / GDP) x 100.

- India’s wealthy opt for term insurance policies worth Rs 5-20 crore: Report.

- The Goods and Services Tax (GST) Council is considering a proposal to Remove GST on Life Insurance & Health Insurance policies. That means in coming time You will get Cheaper Life & Health Insurances.

- The uninsured : 40 crore Indians (30% of Population) are a medical emergency away from financial ruin ( NITI Aayog Report, July 2024 ) => If they do’nt have Health Insurance, Probability is high that they will not have ‘Life Insurance’ also. Just a small disturbance in normal life routine is sufficient to derail the whole planning of a ‘Financial Security’.

IX-Life Insurance Secures Financial Freedom

Life Insurance: Your Shield for Financial Freedom

Life insurance is often misunderstood as a mere death benefit. However, it is a powerful financial tool that can significantly contribute to your ‘Financial Freedom’ and security. By understanding its multifaceted benefits, you can harness its potential to safeguard your future and that of your loved ones.

Securing Your Family’s Future

- Income Replacement: In the unfortunate event of your untimely demise, your family may face a sudden loss of income. Life insurance provides a lump sum payout that can replace your lost income, ensuring their financial stability.

- Debt Clearance: Outstanding debts like home loans, car loans, or credit card debts can become a significant burden for your family. Life insurance proceeds can be used to settle these debts, relieving your loved ones of financial stress.

- Child’s Education: A life insurance policy can serve as a dedicated fund for your child’s education. The lump sum benefit can cover tuition fees, accommodation costs, and other educational expenses.

- Retirement Planning: Certain life insurance policies, such as endowment plans, offer maturity benefits that can supplement your retirement savings. This can help you maintain your desired lifestyle during your golden years.

Building Wealth and Financial Security

- Tax Benefits: Life insurance premiums are often tax-deductible, allowing you to save on taxes and allocate more funds towards your financial goals.

- Investment Opportunities: Some life insurance policies, like ULIPs, offer investment options. You can invest in a variety of funds, including equity, debt, and hybrid funds, to grow your wealth over time.

- Loan Against Policy: In times of financial need, you can avail a loan against your life insurance policy. This can provide immediate liquidity without selling assets or incurring high-interest rates.

- Legacy Planning: Life insurance can be used to create a legacy for your loved ones. You can designate beneficiaries to receive the death benefit, ensuring that your wealth is transferred smoothly to future generations.

Choosing the Right Policy

When selecting a life insurance policy, consider the following factors:

- Financial Needs: Assess your family’s financial needs, including income replacement, debt clearance, child’s education, and retirement planning.

- Budget: Determine how much you can afford to pay as premiums.

- Risk Tolerance: Consider your risk appetite and choose a policy that aligns with your investment goals.

- Life Stage: Your life stage will influence your insurance needs.

For example, young parents may prioritize term life insurance, while retirees may opt for endowment plans or whole life insurance.

By carefully considering these factors and seeking advice from a qualified financial advisor, you can make an informed decision and select a life insurance policy that empowers you to achieve financial freedom.

Additional Tips for Financial Freedom

- Regular Review: Regularly review your life insurance policy to ensure it aligns with your evolving financial needs.

- Diversification: Consider diversifying your investments to spread risk and maximize returns.

- Emergency Fund: Build an emergency fund to cover unexpected expenses.

- Financial Planning: Create a comprehensive financial plan that includes budgeting, saving, and investing strategies.

- Seek Professional Advice: Consult with a financial advisor to receive personalized guidance and recommendations.

Life insurance is a powerful tool that can help you secure your financial future and provide peace of mind. By understanding its benefits and choosing the right policy, you can take a significant step towards achieving financial freedom.

- Financial Needs: Assess your family’s financial needs, including income replacement, debt clearance, child’s education, and retirement planning.

X-Conclusion

Considering all the facts, figures & scenarios it is prudent to take life insurance with proper coverage. See the irony that Everyone of us see everyday people are dying across the world due to various reasons & we all know that if a young breadwinner of a family dies early, what consequences his/her family could face?

But we never think that someday we also will be in the same position. So it is not only our obligation to opt for Life Insurance but also it’s our Moral responsibility to provide ‘Financial Security’ to our family. It is said that, ‘Death is certain, But the timing of Death is not certain that’s why There is Life Insurance.

For Any Further Query Kindly Click Here.